Investing in NFTs. From zero to one

A crash course and a research framework for first time NFTs investors

Hi everyone 👋,

Welcome to High Return. I hope the insights I’m sharing here will help you to yield big wins.

If you are interested in tech, investment trends and all things startups, subscribe to the newsletter. And if you have any questions or feedback - drop me a message. I will be happy to connect.

Investing in NFTs

When I started investing in NFTs, I googled around, read a few posts and bought an artwork within a day. But frankly, none of the guides truly prepared me for each step of the process.

I was pumped, ready and… so unprepared. So I made some rookie mistakes, spend money on wrong projects and high fees. I wish I have found an article like this before I started.

This deep dive will be useful if you’ve already decided to buy NFTs. I don’t plan to pursuade you in making investments in NFTs. Such discussion is beyond the scope of the article.

My main goal is to provide a simple step-by-step guide with a research framework. We will look into what NFTs are, key NFT resources, and how to choose and invest in NFTs.

Let's dive into it!

NFTs definition

By now, you’ve surely heard the term “NFT”. And you probably recall an image of an animated monkey or a pixelized drawing of a person.

NFTs are digital tokens, which track ownership of a unique digital asset - images, music, writing pieces, collectables or physical one like real estate. “Non-fungible” means “irreplaceable“ or “unique“. The digital tokens are stored in a decentralized ledger, a.k.a a blockchain. The records in the ledger serve as a prove of ownership and can’t be altered.

Here is a quick example from Dror Poleg’s piece “Unpacking the Web3 Sausage“ on how NFTs are used today:

A creator can upload an artwork (an image, video, song, text) to a marketplace like OpenSea, and her fans (or speculators) can buy a token that confers ownership and usage rights of said artwork. The buyers can then use the token to sell their rights to other people.

There are several reasons to invest in NFTs. The most popular ones are holding the NFT as a collection, participating in a community, using it as a status symbol, supporting the artist or simply generating profit.

NFTs resources

Before we go through the actual investment process. Let’s have a look at some important resources, which will enable you to do research and find the best NFT collections on the market.

Marketplaces

Currently, you can buy an NFT in two ways - either by minting it from the creators’ website or acquiring it from the secondary market. By minting the NFT, you tokenize the digital art, i.e. you turn it into crypto collectable or a digital asset on the blockchain. After the mint, your digital item is stored in the blockchain. You can now list and sell it to others.

If you buy the NFT from a secondary market, you have to go to an NFT marketplace, find the art and buy it. Once you decide to sell it, you will have to list it again on the marketplace. Here are the largest marketplaces:

Opensea - the first and largest marketplace for NFTs worldwide. It is a great starting point for NFT collectors as it offers the highest number of collections and charges low fees. Opensea supports the ETH blockchains. You will pay a 2.5% royalty fee to Opeansea once you sell your NFTs.

Axie Infinity Marketplace - the marketplace is exclusively dedicated to buying and selling characters from the P2E (play-to-earn) game Axie Infinity. Each Axie is an NFT. The platform charges a 4.25% fee when you buy or sell an Axie NFT.

Cryptopunks - Cryptopunks is both the name of the marketplace and the only collection, that you can buy or sell on it. Cryptopunks is one of the pioneering collections, that brought popularity to the NFT space. If you are new to NFTs, you should probably start with one of the other marketplaces, where the threshold of owning a piece is much lower. The cheapest Cryptopunk is currently sold for 194k USD. The current market capitalization of the collection is around 2.2b USD.

NBA Top Shot - a niche NFT marketplace for NBA and WNBA fans. You can find officially-licensed short video highlights of your favourite players. The marketplace presents the future of trading sports collectables.

Magic Eden - the largest NFT marketplace for the Solana blockchain with 304k traders and 615m USD volume. It has recently surpassed Solanart for the first position as it made the process of listing new collections easier for creators. The platform charges 2% on all transactions.

Solanart - the second-largest NFT marketplace based on the Solana blockchain. The projects are highly curated and sometimes it takes a while until they get listed. If you use Solanart to sell your NFTs, you will have to pay 3% to the platform.

Rarible - a community-owned marketplace administered by its decentralized autonomous organization (DAO). Members of the DAO may vote on a key decision about the future of the platform. Rarible has also issued its token - $RARI, which was previously distributed to active creators and collectors. This enabled some users to exploit the rewarding system and as of the 16th of January, the $RARI rewarding has been ceased as voted by the DAO. Rarible’s fees are 2.5% per transaction from the buyer and the seller.

SuperRare - this platform based on the ETH blockchain specializes in finding digital artists, who create the art sold on SuperRare. SuperRare differentiates itself with its high-end art and careful curation. It charges the artists 15% on initial sales and 2.5% transaction fee for all secondary sales.

Research collection tools

To pick up promising NFTs, you will need to use tools to research data about the NFT drops or existing collections. Here are some of the most popular ones:

Dapp Radar - get an overview of data behind numerous web3 assets - decentralized apps, exchange platforms and of course NFTs. You can find different reports about web3 on their blog or even check how many crypto assets Jay Z owns. You can also see the data about your NFTs and other crypto assets.

Rarity.tools - see the best performing NFTs collections in the last seven days or upcoming NFT drops. As the name suggests, you can check the rarity of your NFT in the tool. We will talk about NFT rarity in the next chapter, but for now, keep in mind that it will influence the NFT’s price.

Upcoming NFT Art - discover upcoming NFT collections. You can see some data around the collections such as number of NFTs, followers on Twitter or members of the Discord channels of the NFT collections.

NFT calendar - it is similar to Upcoming NFT Art. The listed collections might differ. You can visit the page of the collection and find links to Twitter, Discord and the official website.

Icy Tools - use icy tools to discover collections, which are being minted or are generating lots of volumes. You have the option to select periods, e.g. which collections have minted the highest number of NFTs in the last 2 hours.

Solanalysis - analytical tool for projects based on Solana. You can track popular collections, performances and the rarity of the NFTs. The site also provides an overview of upcoming Solana collections.

Research rarity tools

To define the selling price of your NFT, once you own it, you must check its rarity. If your NFT is rare, you can price it higher than the average sold price.

You can find, where creators listed the collection in the collection’s Discord channel by checking the #announcements channel, asking other members or using the search function. If you don’t have information about this, you can have a look at these websites:

These tools essentially provide identical information. Trait Sniper gives you a table overview over full collections at one glimpse, while Rarity Sniffer and Rarity Sniper bet on a more visual UX.

You can filter the collections according to the rank, price, last sale or specific traits of your NFT. Keep in mind, that certain collections will be listed only on one of these tools.

Social media

To make proper research, you will need to use social media tools. Checking the activity of the NFT page on Twitter and in the Discord channel is essential.

NFTs investment step-by-step

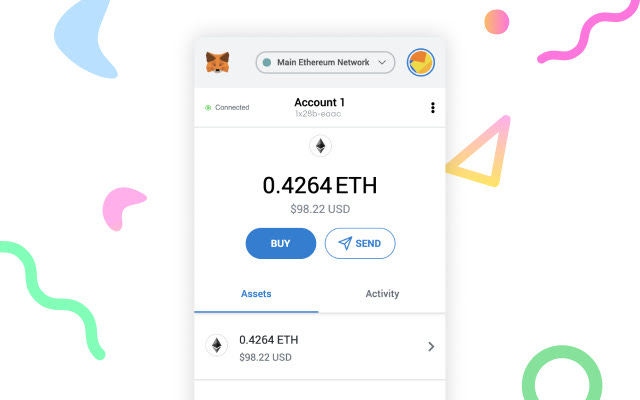

We will walk through an example of buying and selling an NFT on Opensea with the MetaMask crypto wallet, but the process flow will be similar to the one on other marketplaces.

Administrative tasks

You will have to go through three steps:

Step 1 Create a crypto wallet

Popular crypto wallets are MetaMask or Coinbase Wallet.

Step 2 Link your MetaMask account to Opensea

Once you have installed the wallet, you will have to connect it to the Opensea. Visit the website and select wallet on the upper right corner. You will be prompted with a window requesting information about your wallet.

Step 3 Buy ETH

You can buy ETH directly through MetaMask via debit card or Apple Pay. If you use Coinbase, you can buy the ETH on their marketplace via debit card or with a bank account and transfer it to your wallet.

Mint or buy

Step 4 Decide if you want to mint an NFT or buy an existing one

You can choose to mint an NFT from an upcoming collection or buy an existing one on Opensea.

You can only mint NFTs from pre-minted collections. You need to find the collection’s official website and see when the sale starts. Some collections sell in minutes. If you are convinced about the success of the collection, you will have to be fast.

When you mint, you won’t see the NFT, that you are buying directly. It will be generated later, and you will find it in your profile in Opensea.

To buy one, you will have to pick an existing NFT, that has already been minted. You can buy existing NFTs on Opensea by searching in the marketplace. Whether you mint an NFT from an upcoming collection or buy on Opensea, there are several areas of research, which you need to do, before investing.

Research framework

Step 5 Research creators

Go to the NFT collection official page and look for the creators. Not every project with anonymous creators is a scam, but their anonymity is a red flag.

If the artists are listed, research their social media activity. If they have already been active in the NFT space, this is a good sign. If an artist with thousands of followers is preparing an NFT collection and her fans are responding positively, you can assume, that there will be demand for the collection.

Be aware, that some scam projects leverage artists‘ names without any affiliation.

Step 6 Research community

The community around the NFT project is by far the most important factor for its success. If supporters of the project include NFT influencers or have a prominent audience, then the probability of success is increased.

Every member of the NFT community serves as an ambassador. And each ambassador brings more awareness to the collection.

Influential supporters are a great sign for an NFT collection. Posts by them will be retweeted on the Twitter's page, so you can easily spot them. Look at the supporters - if they have a large following base and are promoting the art, this will drive more awareness and demand for the collection.

The majority of the NFT collections have official Twitter accounts. Here you can check the latest updates about the NFTs.

Good signs to look for are strong engagement on the posts by existing followers and reposts by NFT influencers, who are about to or have bought an NFT from the collection.

A large red flag is a huge following base with little to no response of posts. The most probable assumption here is that the followers are bought or the majority of them are bots.

Stay away from such NFT projects. If the creators are lying about the number of followers on their page, they might be lying about the roadmap or anything else around the collection.

Discord

Discord is the major social media channel for NFT fans to interact with each other. I haven't seen a legitimate NFT project, that doesn't have a Discord channel.

This is where the creators and supporters of the project discuss everything around it. An active Discord communication must be a given for a successful project.

Look for the ways, that the creators are engaging the community. Do they offer public AMA meetings or some exclusive events? The higher the level of engagement of the community, the higher the chances, that the members will promote the collection and its worth will increase.

One more important point to look for in Discord is the way how the creators are reacting to criticism. Do they respond positively or ignore it completely? If the artists are ignoring the issues expressed by the community, you can consider it a bad sign.

Step 7 Study the roadmap

A roadmap will be a good starting point to understand what the future of the NFT collection looks like and whether the creators have invested time to think about the steps beyond raising money.

A positive sign is the commitment of the creators to invest in the community wallet. In many cases, creators will decide to invest in promoting the collection.

Step 8 Understand the purpose

The purpose of a project might play a significant role in its future success. If an owner can identify with the purpose, this will make it easier to buy the NFT.

There are numerous examples of purpose-driven NFTs such as Alpha Girl Club, which supports female representation in the NFT space and mental health, or the Psychedelics Anonymous Genesis, which promotes the adoption of psychedelic-assisted therapy (CPAT).

Step 9 Evaluate the artwork

I agree, that this point is vague. But if you don't like the art and you aren't able to sell it, you will be stuck with something, that you dislike.

On the other hand, the art needs to be relatable also to other people. Otherwise, the NFT won't have any liquidity on the market.

Buying the NFT

Step 10 Buying the NFT

If you want to mint the NFT, visit the official page of the collection and do it from there. If you want to buy it, go to Opensea and click on the buy button. Once you click on mint or buy, you will be prompted with a message from your wallet. This will show you the final amount of money, that you need to mint or buy the NFT.

Look at the gas fees and make sure you are comfortable giving away this amount of money. The gas fees are the fees rewarded to the blockchain miners. There amount is dependent on the activity on the blockchain at the time of the order. The gas fees for buying may vary significantly. But you can assume, that you will pay between 50 and 150 EUR for them.

Step 11 Selling the NFT

If you want to sell your NFT, the easiest way is to list it on Opensea. Be aware, that Opensea will require you to initialize your wallet for your first sale. This is a one-time process. The gas fees for initializing may vary between 50 and 250 EUR.

You can choose between two types of selling - for a fixed price or to the highest bidder. For a fixed price, just pick the price, that you want to receive for the NFT. Keep in mind, that you must sell the item, once someone offers you this price.

You will have to pay the gas fees for selling, which range between 8 and 35 EUR. If you sell via timed auction, you can choose between two options - sell to the highest bidder or sell with a declining price.

If you sell to the highest bidder and there is a bid above 1 ETH, Opensea will cover the gas fees from the sale. If there is no bid above 1 ETH, you can choose to either accept the highest bid or keep the item.

Selling with a declining price, you must list a high price - the starting point of the sale, the low price - the final price of the sale if there are no buyers throughout the auction, and the auction’s duration.

Once, the auction has started, the price of your item will gradually decrease and reach a low price if there are no buyers during the different price levels.

Conclusion

NFTs are still in their early days. They have the potential to become an integral part of the crypto-economy, and the NFT community is growing strongly.

There is, however, a lot of scepticism around the substantial value of the NFTs. Investing in them is still very speculative. And an NFT’s value might be extremely volatile. It can increase or decrease by 100% or more overnight.

Beyond the absolute value of an NFT, however, you can gain access to like-minded people and valuable relationships. These intangible assets are massively overlooked and may provide you with the highest return of investment in the long term.

It’s exciting to be part of NFT projects and I hope, that this article will help you find your own unique approach to investing in NFTs.

Disclaimer: The above references an opinion and is for information purposes only. It is not investment advice. Consider NFTs a high-risk investment and buy digital art with caution.